Bank Fever: When Founding Financial Fortresses Becomes a Frenzied Craze

Picture this: a bustling town square, not with farmers markets or town criers, but with grand facades emblazoned with the words “First National Bank,” “The People’s Savings Bank,” and even “Grandma’s Pickle Jar Financial Emporium.” It’s not a scene from a Monopoly board, but a historical phenomenon known as bancomania – a feverish craze for establishing new banks that swept across continents and eras.

![A captivating photograph of a 12th-grade English exam question paper in Tamil Nadu. Shot with a vintage 50mm lens, the image exudes nostalgia, echoing the bygone era of academic challenges. Inspired by the works of Ansel Adams, the scene is bathed in monochromatic tones, capturing the gravity of the examination setting. Students' expressions reflect a mix of concentration and determination. Soft, natural lighting enhances the atmosphere, evoking a sense of scholarly introspection. --v 5 --stylize 1000

/imagine prompt: An evocative illustration of the 12th-grade English exam paper in Tamil Nadu, reminiscent of classic book illustrations. Channeling the style of Arthur Rackham, the image portrays a whimsical interpretation of academic exploration, blending reality and fantasy. Rich colours and intricate details bring the questions to life, engaging the viewer's imagination. The scene is illuminated by warm, ambient light, creating a cozy, inviting atmosphere. --v 5 --stylize 1000

/imagine prompt: A visually stunning Pixar 3D rendering of the Tamil Nadu 12th-grade English exam paper. Drawing inspiration from the enchanting world of "Up," the questions float in the air, animated with vibrant colours and playful movements. The characters display a mix of curiosity and intellect, conveying the essence of academic inquiry. The scene is bathed in warm, golden hues, creating a magical ambiance. --v 5 --stylize 1000

/imagine prompt: A mesmerising digital illustration capturing the essence of the 12th-grade English exam paper in Tamil Nadu. Infused with the style of M.C. Escher, the questions weave together in an intricate, mind-bending pattern. Subtle shades of blue and grey enhance the intellectual depth of the scene, inviting contemplation. The lighting is surreal, casting shadows that add a touch of mystery to the academic landscape. --v 5 --stylize 1000

Negative prompts: ugly, tiling, poorly drawn hands, poorly drawn feet, poorly drawn face, out of frame, mutation, mutated, extra limbs, extra legs, extra arms, disfigured, deformed, cross-eye, Body out of frame, Blurry, Bad art, Bad anatomy, Blurred, Watermark, Grainy, Duplicate

User

The 19th century's gold rushes in California and Australia weren't just about prospectors getting rich quickly. They pumped a fresh, shiny supply of gold into the global financial system, creating a gold-fueled frenzy that trickled down to everyone, including aspiring tycoons with dreams of banking empires. Suddenly, everyone with a few nuggets and a spare room saw themselves as the next J.P. Morgan.

ChatGPT

Created with AIPRM Prompt "AI Image Prompt Generator"

Prompt [1812088835618897920]:

/imagine prompt: An awe-inspiring photograph capturing the essence of the 19th century gold rushes in California and Australia. Taking inspiration from the historical lens of Mathew Brady, the image portrays the bustling energy of prospectors-turned-tycoons in a sepia-toned landscape. The lens, set at 50mm, captures the intricate details of hopeful faces and gleaming gold nuggets, evoking the financial fervour of the era. Soft, natural lighting bathes the scene, creating a nostalgic atmosphere. --v 5 --stylize 1000

/imagine prompt: A detailed illustration reminiscent of the 19th century gold rushes, crafted in the style of Winslow Homer. The scene unfolds with aspiring tycoons surrounded by gold, reflecting a sense of ambition and opportunity. Earthy tones and precise linework bring depth to the image, highlighting the dreams of banking empires. Warm lighting enhances the historical ambiance, conveying the spirit of the gold-fueled frenzy. --v 5 --stylize 1000

/imagine prompt: A captivating Pixar 3D rendering of the 19th century gold rushes, inspired by the animation brilliance of "The Good Dinosaur." Prospectors, transformed into animated characters, navigate a landscape filled with glistening gold. The colour palette is vibrant, expressing the excitement of newfound wealth, while dynamic lighting adds a cinematic touch to the scene. --v 5 --stylize 1000

/imagine prompt: A mesmerising digital illustration portraying the gold rushes with a touch of steampunk elegance, influenced by the artistry of Brian Kesinger. Aspiring tycoons in Victorian attire engage in financial pursuits amidst golden landscapes. The image, with its warm tones and intricate details, captures the blend of ambition and opulence. Soft, diffused lighting adds a touch of mystery, enhancing the allure of the historical setting. --v 5 --stylize 1000

Negative prompts: ugly, tiling, poorly drawn hands, poorly drawn feet, poorly drawn face, out of frame, mutation, mutated, extra limbs, extra legs, extra arms, disfigured, deformed, cross-eye, Body out of frame, Blurry, Bad art, Bad anatomy, Blurred, Watermark, Grainy, Duplicate

User

Bancomania wasn't limited to Wall Street sharks or aristocratic financiers. Blacksmiths in Pennsylvania, grocers in London, and even cobblers in Paris all jumped on the bandwagon, setting up shop as bankers. Who needed stuffy mahogany desks when you had a trusty anvil or a well-worn workbench?

This democratization of banking, while bringing financial services closer to the people, also had its pitfalls. Many of these fledgling banks lacked the experience or expertise to navigate the ever-shifting tides of the financial world. Regulations were minimal, and oversight was practically non-existent. It was a Wild West with ledgers instead of six-shooters.

ChatGPT

Created with AIPRM Prompt "AI Image Prompt Generator"

Prompt [1812088835618897920]:

/imagine prompt: A captivating photograph capturing the democratization of banking during Bancomania, where blacksmiths, grocers, and cobblers turned bankers. Drawing inspiration from Dorothea Lange's documentary style, the image showcases ordinary workspaces transformed into makeshift banks. Shot with a 50mm lens, the details of ledgers on workbenches and anvils tell a tale of financial ambition. Warm lighting envelops the scene, emphasizing the grassroots approach to banking. --v 5 --stylize 1000

/imagine prompt: A detailed illustration inspired by the democratization of banking, reminiscent of the works of Norman Rockwell. Everyday individuals take on the roles of bankers in charming, bustling scenes. Rich colours and meticulous details depict the anvil, workbench, and ledger as tools of financial empowerment. Soft, natural lighting evokes a sense of nostalgia and simplicity. --v 5 --stylize 1000

/imagine prompt: A whimsical Pixar 3D rendering of Bancomania's democratization of banking, inspired by the playful style of "Ratatouille." Cobblers and blacksmiths transform their shops into banks, animated with lively characters. The colour palette is vibrant, reflecting the eclectic mix of professions turned financiers. Dynamic lighting adds a touch of adventure to the scene. --v 5 --stylize 1000

/imagine prompt: A captivating digital illustration portraying the democratization of banking with a steampunk twist, influenced by the artistry of Greg Rutkowski. Ordinary workplaces morph into banks with cogs and gears. The image, with its warm tones and intricate details, captures the dual nature of financial ambition and the pitfalls of inexperience. Soft, diffused lighting adds a touch of mystery, enhancing the atmosphere of this financial frontier. --v 5 --stylize 1000

Negative prompts: ugly, tiling, poorly drawn hands, poorly drawn feet, poorly drawn face, out of frame, mutation, mutated, extra limbs, extra legs, extra arms, disfigured, deformed, cross-eye, Body out of frame, Blurry, Bad art, Bad anatomy, Blurred, Watermark, Grainy, Duplicate

User

Inevitably, the bubble burst. Economic downturns, poor lending practices, and a general lack of banking know-how led to bank failures. The once-booming town squares, filled with gleaming bank facades, became ghost towns of shuttered windows and "closed for good" signs. Bancomania had gone bust.

But from the ashes of failed dreams and lost savings, valuable lessons were learned. Banking regulations tightened, professional standards were established, and the era of the DIY banker came to an end. While the sight of a blacksmith offering investment advice may seem comical today, bancomania reminds us of the cyclical nature of financial booms and busts, and the importance of a sound and regulated financial system.

ChatGPT

Created with AIPRM Prompt "AI Image Prompt Generator"

Prompt [1812088835618897920]:

/imagine prompt: A poignant photograph capturing the aftermath of Bancomania's collapse, inspired by the documentary style of Sebastião Salgado. The image portrays once-prosperous town squares now transformed into ghost towns, with gleaming bank facades replaced by shuttered windows and "closed for good" signs. Shot with a 50mm lens, the details tell a story of lost dreams. Cool tones evoke a sense of melancholy, highlighting the impact of economic downturns. --v 5 --stylize 1000

/imagine prompt: An evocative illustration depicting the demise of Bancomania, influenced by the emotional realism of Edward Hopper. Town squares, once vibrant with bank facades, now stand desolate with "closed for good" signs. Muted colours and careful linework convey a sense of loss and reflection. Soft, ambient lighting enhances the somber atmosphere, emphasizing the lessons learned from failed dreams. --v 5 --stylize 1000

/imagine prompt: A captivating Pixar 3D rendering of the aftermath of Bancomania, drawing inspiration from the emotional depth of "Inside Out." Town squares transform into animated ghost towns, with bank facades fading into memories. The colour palette shifts from vibrant to muted, reflecting the change in fortunes. Dynamic lighting adds a cinematic touch, conveying the cyclical nature of financial booms and busts. --v 5 --stylize 1000

/imagine prompt: A thought-provoking digital illustration inspired by the demise of Bancomania, influenced by the surreal style of Salvador Dalí. Town squares become surreal landscapes, with bank facades melting away. The colour temperature oscillates between warm and cool, symbolizing the cyclical nature of financial systems. Soft, dreamlike lighting adds a touch of introspection to the scene. --v 5 --stylize 1000

Negative prompts: ugly, tiling, poorly drawn hands, poorly drawn feet, poorly drawn face, out of frame, mutation, mutated, extra limbs, extra legs, extra arms, disfigured, deformed, cross-eye, Body out of frame, Blurry, Bad art, Bad anatomy, Blurred, Watermark, Grainy, Duplicate

User

Inevitably, the bubble burst. Economic downturns, poor lending practices, and a general lack of banking know-how led to bank failures. The once-booming town squares, filled with gleaming bank facades, became ghost towns of shuttered windows and "closed for good" signs. Bancomania had gone bust.

But from the ashes of failed dreams and lost savings, valuable lessons were learned. Banking regulations tightened, professional standards were established, and the era of the DIY banker came to an end. While the sight of a blacksmith offering investment advice may seem comical today, bancomania reminds us of the cyclical nature of financial booms and busts, and the importance of a sound and regulated financial system.

ChatGPT

Created with AIPRM Prompt "AI Image Prompt Generator"

Prompt [1812088835618897920]:

/imagine prompt: An impactful photograph depicting the aftermath of Bancomania's collapse, inspired by the emotive style of Lewis Hine. Town squares, once vibrant, now stand as ghost towns with shuttered windows and "closed for good" signs, symbolizing the end of the financial frenzy. Shot with a 50mm lens, the details reveal the decay of economic dreams. Cool tones create a somber mood, accentuating the impact of economic downturns. --v 5 --stylize 1000

/imagine prompt: A powerful illustration inspired by the downfall of Bancomania, echoing the storytelling approach of George Bellows. Ghost towns emerge from once-prosperous squares, now adorned with "closed for good" signs. Muted colours and expressive linework capture the essence of lost fortunes. Soft, natural lighting adds a touch of melancholy, underscoring the lessons learned. --v 5 --stylize 1000

/imagine prompt: An engaging Pixar 3D rendering visualizing the aftermath of Bancomania, drawing inspiration from the dynamic animation of "Toy Story." Ghost towns materialize, featuring animated bank facades with "closed for good" signs. The colour palette shifts from vibrant to muted, reflecting the changing fortunes. Dynamic lighting adds a cinematic quality, emphasizing the cyclical nature of financial booms. --v 5 --stylize 1000

/imagine prompt: A thought-provoking digital illustration capturing the consequences of Bancomania's collapse, influenced by the surreal style of Rene Magritte. Ghostly town squares feature melting bank facades, symbolizing lost dreams. The colour temperature fluctuates, creating an unsettling atmosphere. Soft, dreamlike lighting enhances the introspective mood, portraying the cyclical nature of financial systems. --v 5 --stylize 1000

Negative prompts: ugly, tiling, poorly drawn hands, poorly drawn feet, poorly drawn face, out of frame, mutation, mutated, extra limbs, extra legs, extra arms, disfigured, deformed, cross-eye, Body out of frame, Blurry, Bad art, Bad anatomy, Blurred, Watermark, Grainy, Duplicate](https://webapk.online/wp-content/uploads/2023/12/LimeWire-AI-Studio-Asset-2023-12-19T123856.337.jpeg)

Think of it as the tech bubble’s less digital cousin. Just as everyone and their dog seemed to be launching a dot-com company in the late 90s, bancomania saw barbers, bakers, and even blacksmiths throwing their hats (and sometimes their savings) into the ring, founding banks with the same enthusiasm as someone starting a lemonade stand.

But what sparked this financial fervor? Why did the mere sight of a banker in a top hat suddenly seem more glamorous than a baker in a flour-dusted apron? Buckle up, history buffs, for we’re about to take a whirlwind tour through the fascinating (and sometimes disastrous) world of bancomania.

Read this out also moped blended word(2023)

Gold Rush Fever and the Seed of Speculation:

It all started with, you guessed it, gold. The 19th century’s gold rushes in California and Australia weren’t just about prospectors getting rich quickly. They pumped a fresh, shiny supply of gold into the global financial system, creating a gold-fueled frenzy that trickled down to everyone, including aspiring tycoons with dreams of banking empires. Suddenly, everyone with a few nuggets and a spare room saw themselves as the next J.P. Morgan.

This speculative spirit wasn’t just about greed, though. The burgeoning industrial revolution created a new economic landscape, one thirsty for capital and financial services. With traditional banks often seen as stodgy and out of touch, the door was flung open for a wave of newcomers, eager to cater to the needs of a rapidly changing world.

From Barbershops to Boardrooms: The Rise of the Everyday Banker:

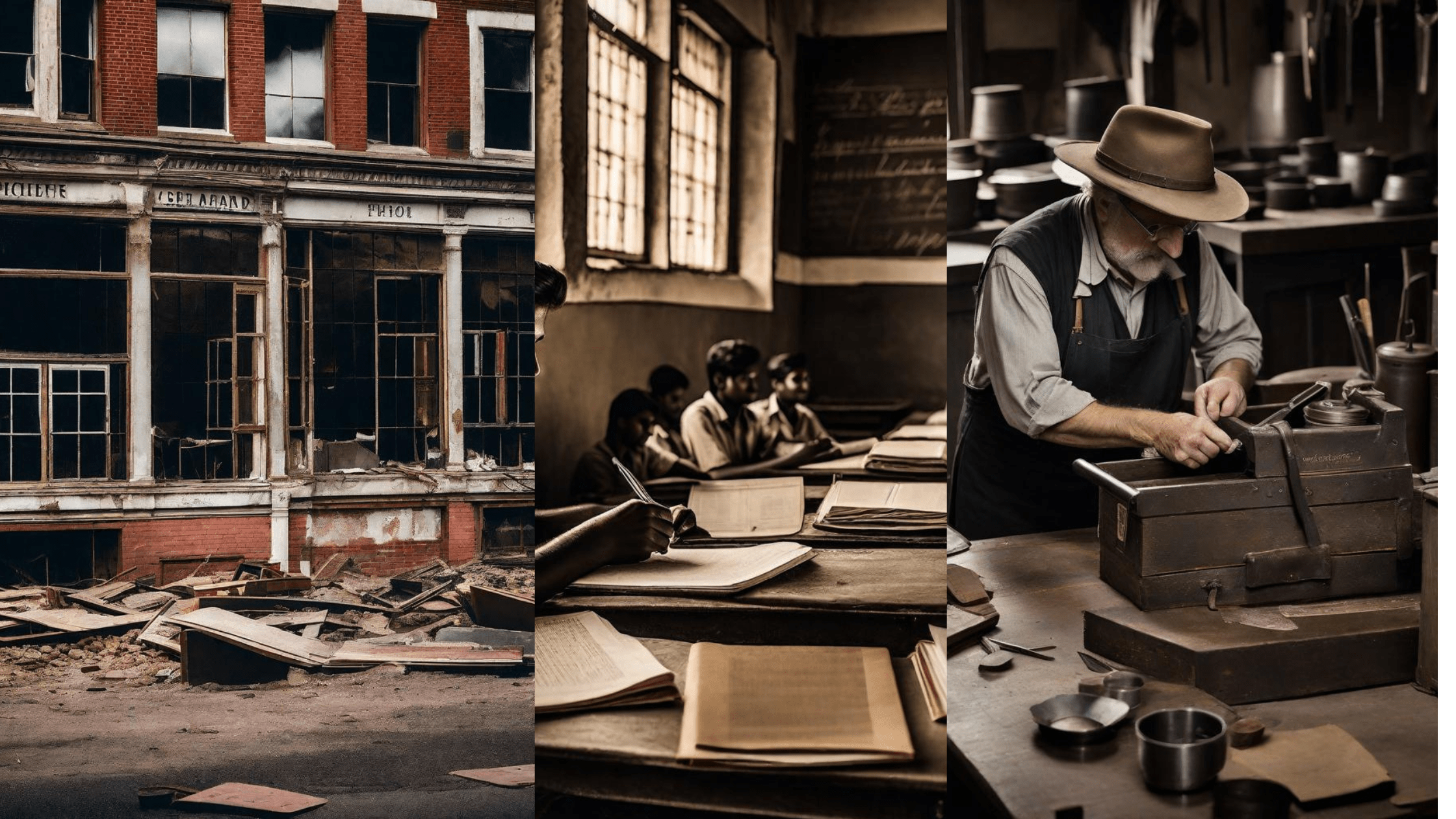

And newcomers did come. Bancomania wasn’t limited to Wall Street sharks or aristocratic financiers. Blacksmiths in Pennsylvania, grocers in London, and even cobblers in Paris all jumped on the bandwagon, setting up shop as bankers. Who needed stuffy mahogany desks when you had a trusty anvil or a well-worn workbench?

This democratization of banking, while bringing financial services closer to the people, also had its pitfalls. Many of these fledgling banks lacked the experience or expertise to navigate the ever-shifting tides of the financial world. Regulations were minimal, and oversight was practically non-existent. It was a Wild West with ledgers instead of six-shooters.

Boom, Bust, and the Lessons Learned:

Inevitably, the bubble burst. Economic downturns, poor lending practices, and a general lack of banking know-how led to bank failures. The once-booming town squares, filled with gleaming bank facades, became ghost towns of shuttered windows and “closed for good” signs. Bancomania had gone bust.

But from the ashes of failed dreams and lost savings, valuable lessons were learned. Banking regulations tightened, professional standards were established, and the era of the DIY banker came to an end. While the sight of a blacksmith offering investment advice may seem comical today, bancomania reminds us of the cyclical nature of financial booms and busts, and the importance of a sound and regulated financial system.

Beyond the Boom: Bancomania’s Legacy:

The legacy of bancomania isn’t just cautionary tales of lost fortunes and shattered dreams. It’s also a testament to the human spirit of innovation and the desire to carve out a piece of the economic pie. It’s a reminder that financial services are not the exclusive domain of the elite, but something that can be shaped and reshaped by the communities they serve.

So, the next time you walk past a bank (whether it’s housed in a grand marble building or a converted bakery), take a moment to remember the times when anyone, even a pickle jar entrepreneur, could catch the bank fever and join the financial rodeo. Just don’t forget to hold onto your savings, partner, history has a way of repeating itself.